Bang Si-hyuk’s Alleged 400 Billion Won Stock Scheme: A Breakdown of the BigHit IPO Controversy

A viral post on Korean community site Theqoo has sparked controversy by accusing Bang Si-hyuk, the founder of BigHit Entertainment (now HYBE), of orchestrating a secretive stock scheme that earned him a massive profit of around 400 billion won ahead of the company’s initial public offering (IPO) in 2020.

Alleged Timeline of Events

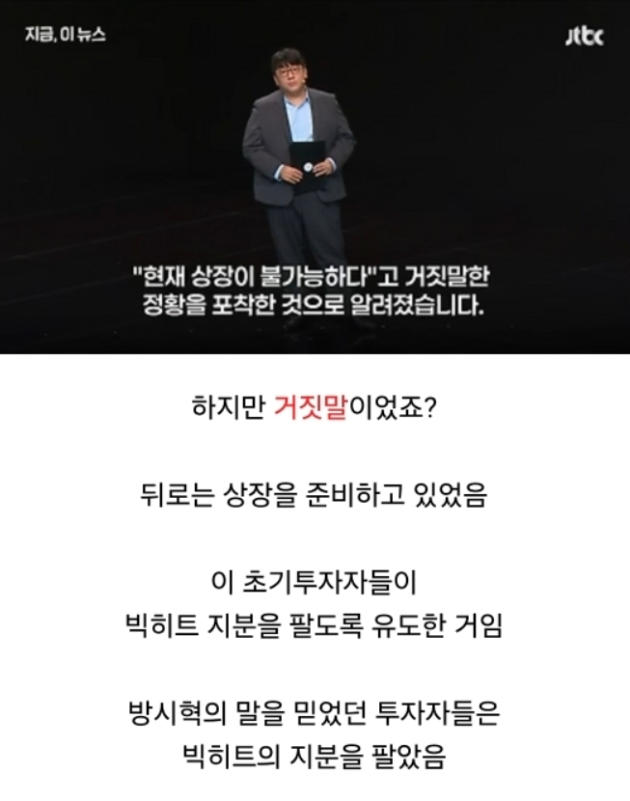

According to the post, just one day before BigHit’s IPO, Bang Si-hyuk reportedly told early investors that there were “no plans for BigHit to go public.” However, this statement contradicted internal preparations that were already underway for the company’s market debut.

Trusting his words, many early investors sold off their shares. These were soon purchased by three private equity funds (PEFs) at prices ranging from 30,000 to 40,000 won per share. Notably, the PEFs were allegedly founded by individuals closely tied to Bang Si-hyuk.

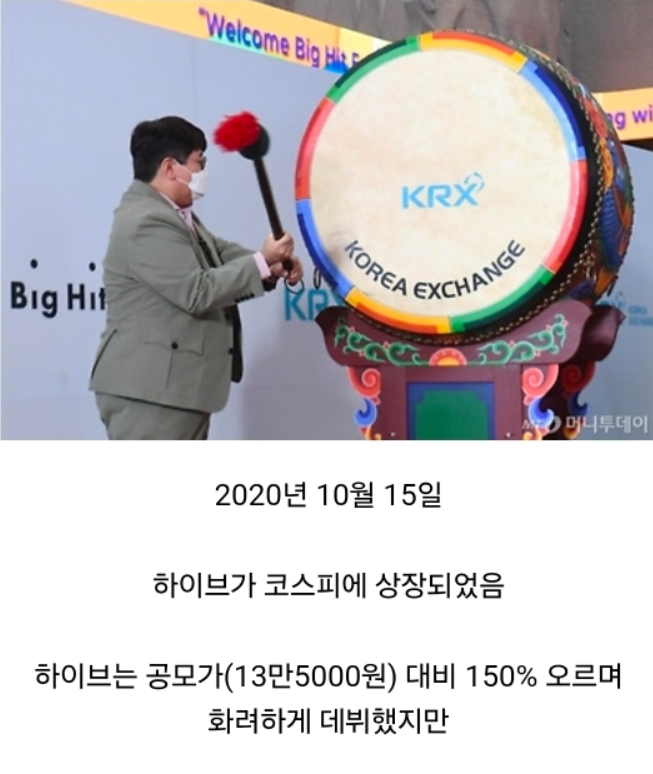

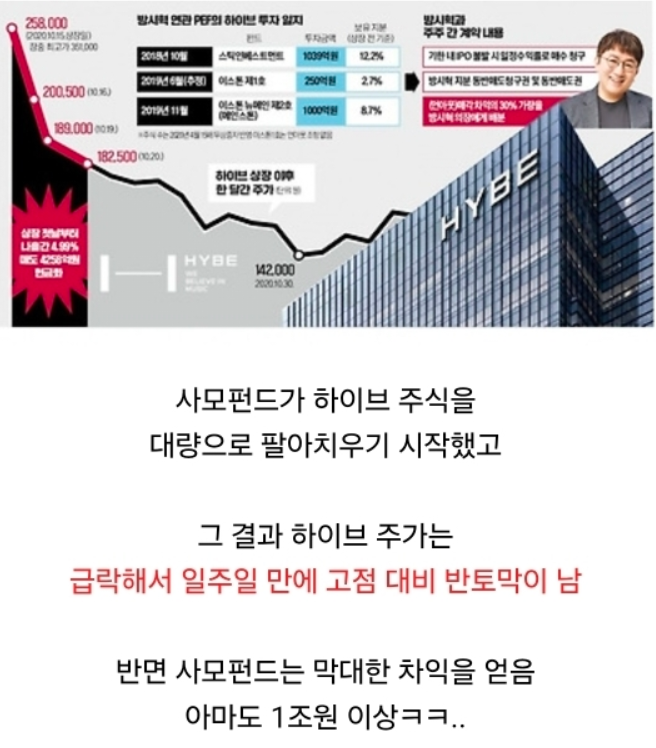

On October 15, 2020, HYBE officially listed on the KOSPI. The stock surged over 150% above its offering price of 135,000 won on its first day, reaching a peak of 350,000 won. However, the PEFs soon began dumping large volumes of HYBE stock, which caused the share price to plummet to nearly half its peak value within a week.

During this period, the PEFs reportedly made profits exceeding 1 trillion won. After offloading all shares, the funds dissolved—one was formed just a year before the IPO and shut down a year after, raising suspicions about their true purpose.

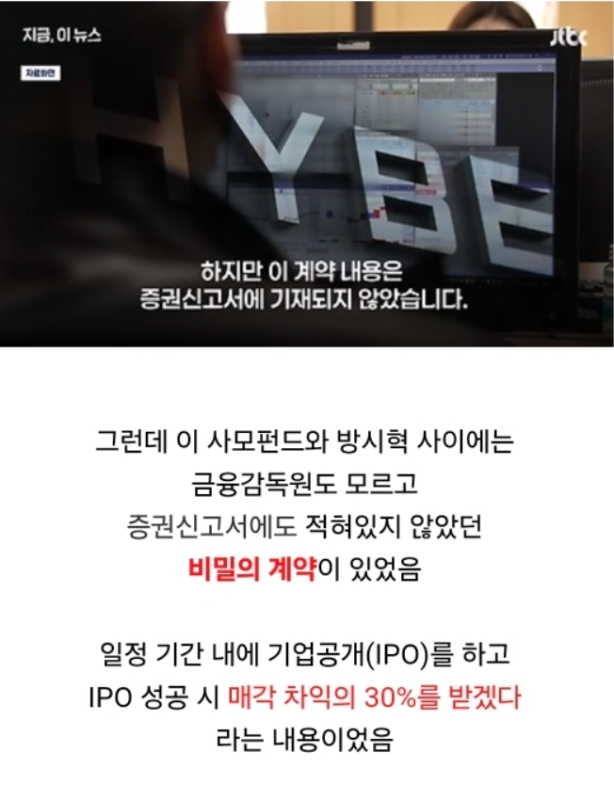

The post further alleges that a confidential agreement existed between Bang Si-hyuk and the PEFs, which was neither reported to the Financial Supervisory Service nor disclosed in HYBE’s securities filings. This agreement supposedly guaranteed Bang Si-hyuk 30% of the capital gains if the IPO succeeded, resulting in a personal gain of approximately 400 billion won.

Close associates linked to the funds are also said to have pocketed hundreds of billions of won in profits. Critics argue that this clandestine deal severely harmed small investors, who suffered financial losses when the stock price crashed post-IPO.

Ongoing Investigations

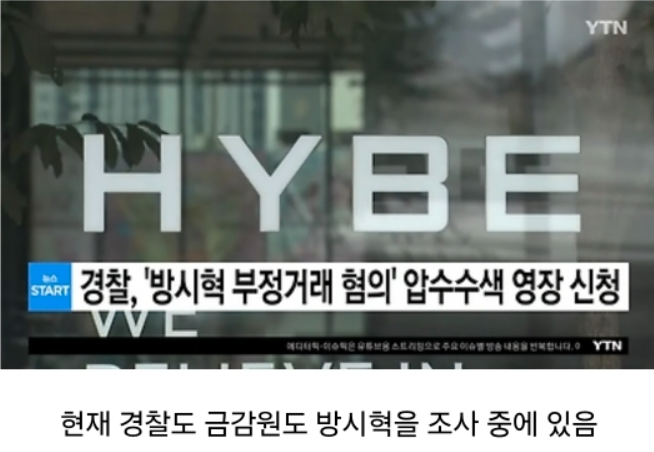

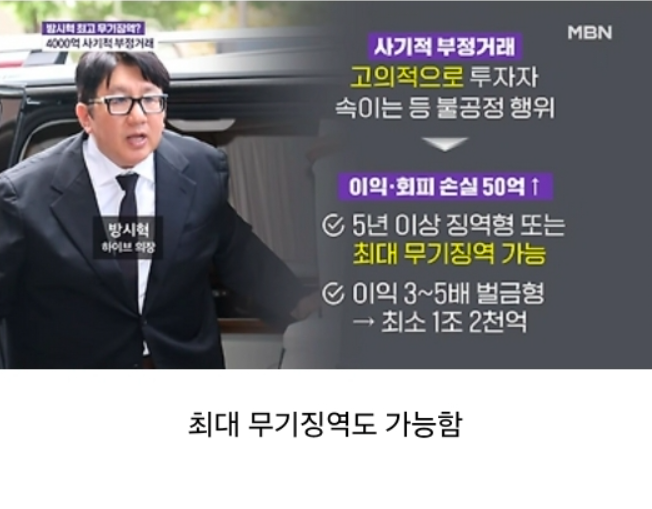

Both the police and South Korea’s Financial Supervisory Service are currently investigating the matter. If the allegations prove true, Bang Si-hyuk could face severe legal consequences, including the possibility of life imprisonment under financial crime laws.

In response to growing scrutiny, HYBE stated:

All four underwriters and legal advisors determined that, since the agreement between certain shareholders did not cause any financial loss to general shareholders, it was not something that needed to be disclosed in the securities registration statement.

However, many netizens remain unconvinced. Some users argue that the magnitude of this issue far exceeds other ongoing corporate controversies, such as the one involving NewJeans.

- Give him life imprisonment. I never want to see him again.

- I hope people who treat this like a joke and chase after quick profits get severely punished. There are way too many of them these days.

- Stock manipulators should get the death penalty. They shouldn’t be allowed to use the money they made — that’s the only way to stop this kind of thing.

- He should be sentenced to death. Forget NewJeans—this kind of crime is like a cancer shaking the foundation of Korea’s economy. And it’s clear now that Bang Sihyuk has sociopathic tendencies. This is a serious evil in our society, and we absolutely cannot just let it slide. This isn’t just about K-pop. This is about a type of person who thrives by sucking others dry.

- He seriously deserves life imprisonment. Korea is way too lenient when it comes to stock manipulation and financial crimes.

- What an incredible (in a bad way) human being.

- Isn’t he just completely insane? FFS, go after the guy who scammed over a trillion won from 400 billion. People were out here defending him like crazy? This is textbook financial crime. You guys say your boss is on Lee Jae-yong’s level, but even Lee Jae-yong wouldn’t pull something like this.

As the investigation unfolds, calls for transparency and accountability are growing louder within Korea’s investment community.