K-pop Big 4’s 1st Quarter Stock Shake-Up: SM, YG, HYBE Soar – JYP Stumbles Amid the Rise

Despite ongoing trade tensions and tariff policies under the Trump administration, the big four Korean entertainment companies, HYBE, SM, YG, and JYP, have gained significant attention globally, leading to expectations of further stock price growth in 2025.

The entertainment industry, particularly digital content, has been less impacted by tariff policies. The potential easing of the “Hallyu Ban” (restrictions on Korean cultural exports to China) is also expected to contribute to improved financial performance.

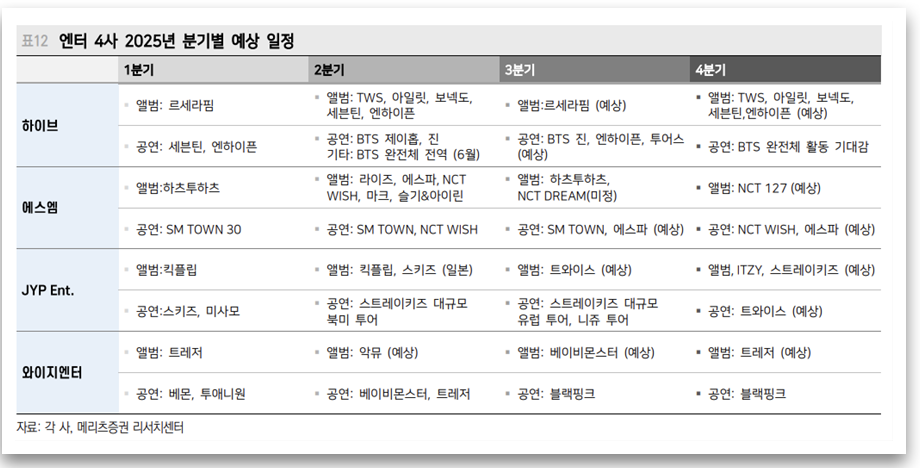

What is currently driving the market is the comeback of major K-pop artists and the debut of new groups. The future performance of entertainment stocks will largely depend on new group debuts, content exports, and platform expansion during the second half of the year.

Stock Performance in Q1: SM, YG, and HYBE Thrive, JYP Struggles

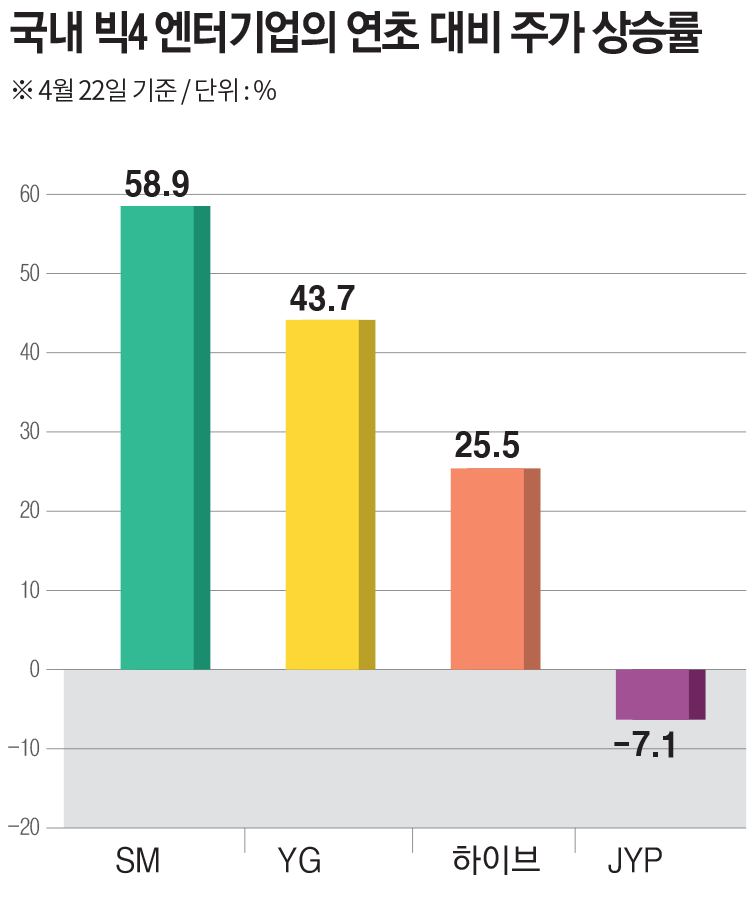

According to the Korea Exchange, SM Entertainment’s stock price closed at 113,600 KRW on April 22, a 0.09% increase. From the beginning of the year, SM’s stock has surged by 58.9%, compared to a 5.42% drop on January 2.

Similarly, YG Entertainment saw a 43.2% increase in stock price since the start of the year, while HYBE’s stock grew by 25.5%.

These positive price movements are largely attributed to strategic artist activity planning and the companies’ global market expansion. SM’s strong performance can be credited to the recovery of the Chinese market and the debut of the new girl group Hearts2Hearts. YG, on the other hand, has benefited from BLACKPINK‘s continued global presence and the debut of BABYMONSTER, alongside a refocus on its core music business. HYBE’s stock was boosted by the anticipation of a full group return of BTS and a steady increase in revenue from its platform, Weverse.

However, JYP Entertainment saw a 7.1% decline in its stock price. This drop was linked to several factors, including the inactivity of some key artists and underperformance from new groups. Analysts suggest that JYP has faced challenges in securing market share amid intensifying global competition.

Recovery Expected in Q2: Strong Earnings Momentum

As interest shifts from tech stocks to content stocks, K-pop entertainment companies are set to experience a recovery in earnings beginning in Q2. The major touring seasons and key artist comebacks during this period are expected to significantly boost revenue streams. Analysts predict that entertainment stocks, which have a strong correlation with earnings, will likely see upward trends in the second half of the year.

SM are forecast to continue their growth trajectory in Q2 with the return of major artists. SM’s ongoing collaborations with various companies are expected to result in continued IP-driven revenue growth.

YG’s strong performance is projected to be sustained by BLACKPINK’s global tours and the rise of new groups like BABYMONSTER and TREASURE.

HYBE’s dominance is expected to continue, with its pipeline of successful IPs, including BTS, ENHYPEN, LE SSERAFIM, and TXT, set to drive revenue growth through 2026.

JYP, despite its Q1 slump, is anticipated to benefit from a strong second half of the year, with major artist tours such as Stray Kids‘ North American tour boosting its financial performance.

Conclusion: Positive Outlook for Entertainment Stocks

The second quarter is expected to be a turning point for the K-pop entertainment industry, with key artist comebacks, global tours, and platform expansion expected to bolster financial results. Analysts are optimistic about the sector’s prospects, and many have raised their target stock prices for companies like SM, YG, HYBE, and JYP.

Entertainment stocks, which are sensitive to earnings performance, are likely to see a rebound in the latter half of 2025.