Shocking SK Telecom Hacking Case: Victim’s Bank Account Drained of 50 Million KRW After Mysterious Phone Line Opened

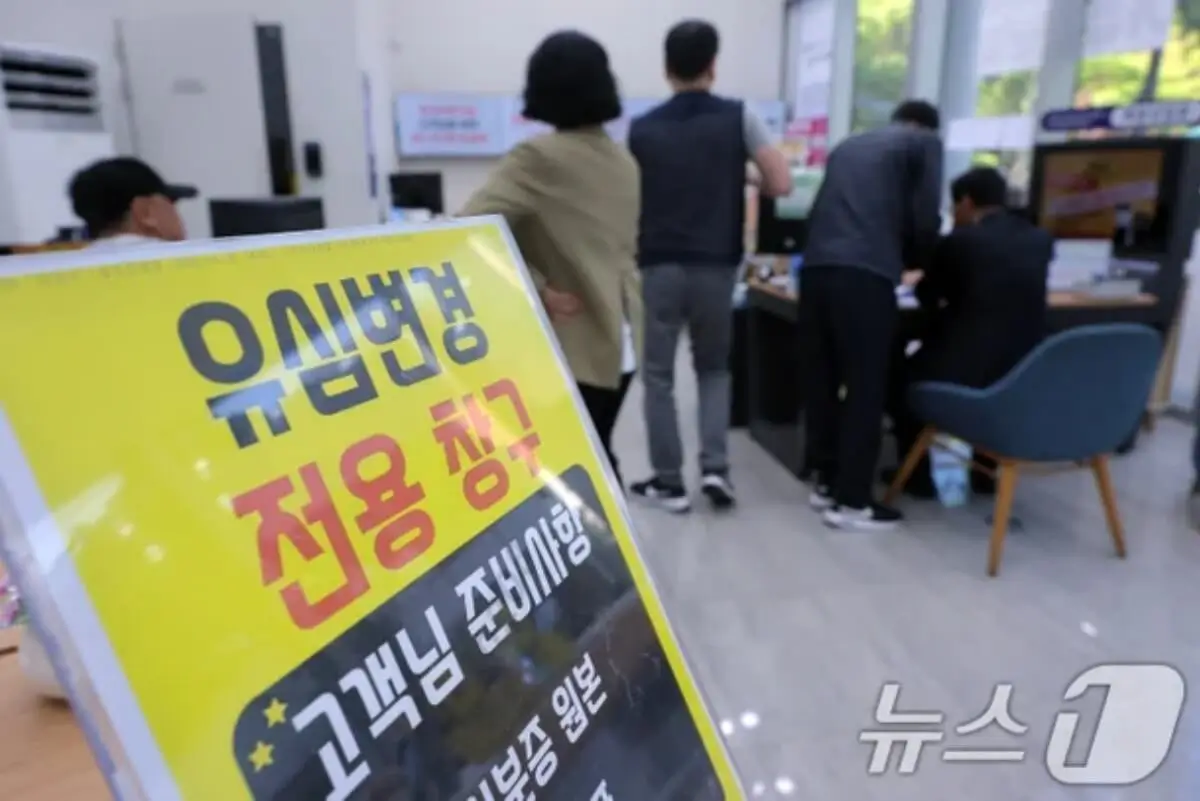

In the aftermath of a suspected SK Telecom (SKT) security breach, a Busan resident has reported a major case of identity theft and financial fraud, prompting police to launch an official investigation.

The Busan Nambu Police Station announced on April 28 that they had received a report from a victim in their 60s, referred to as Mr. A, regarding the fraudulent opening of a mobile line and the subsequent theft of 50 million KRW (approximately $35,000 USD) from his bank account.

According to authorities, Mr. A’s ordeal began on April 22 when his phone suddenly stopped working. Concerned, he visited a mobile service center where he discovered that a new mobile line had been opened under his name without his authorization. Further investigation revealed that five separate transfers of 5 million KRW each had been made from his bank account to an unknown recipient, totaling 50 million KRW.

Immediately after uncovering the fraud, Mr. A filed a report with the police and requested a payment suspension on his bank account to prevent further losses. A spokesperson from the Busan Nambu Police Station stated, “The investigation is still in its early stages, so we cannot disclose specific details,” but added that they are thoroughly examining both the unauthorized phone activation process and the bank transaction history to track down the perpetrators.

This incident comes shortly after SK Telecom acknowledged a potential security breach. On April 19, SKT detected suspicious signs suggesting that some subscriber SIM card information may have been leaked due to a hacker’s malware attack. In response, SKT stated they had immediately deleted the malware and isolated compromised equipment to contain the breach.

While it remains unclear whether Mr. A’s case is directly connected to the SKT breach, the timing has heightened public concern over mobile security and personal data protection. As the investigation unfolds, authorities are urging all users to monitor their mobile accounts and banking activity closely for any suspicious behavior.